The Best Forex Trading Platform

Forex trading is a highly dynamic and complex market that requires a deep understanding of currencies, global economies, and geopolitical factors. Even with the right knowledge, achieving consistent profitability can be challenging. However, choosing the best forex trading platform can significantly improve a trader’s ability to analyze the market, execute trades efficiently, and manage risks effectively.

A top-tier forex trading platform provides advanced tools, real-time data, and seamless trade execution, helping traders minimize losses and maximize profits. The right platform enhances the trading experience by offering features such as technical indicators, automated trading options, and user-friendly interfaces. Trading on a reliable and well-equipped platform not only improves performance but also opens the door to passive income opportunities, making it easier to achieve financial stability in the long run.

A top-tier forex trading platform provides advanced tools, real-time data, and seamless trade execution, helping traders minimize losses and maximize profits. The right platform enhances the trading experience by offering features such as technical indicators, automated trading options, and user-friendly interfaces. Trading on a reliable and well-equipped platform not only improves performance but also opens the door to passive income opportunities, making it easier to achieve financial stability in the long run.

How to Choose the Best Platform?

1. Pricing

Most online forex trading platforms provided by brokers are free of charge for traders. While some brokers may impose a fee for using specific platforms, our research found that the majority cover platform costs, allowing traders to use them at no additional expense. Choosing a broker that offers a free yet high-quality trading platform ensures you get access to essential trading tools without extra financial burdens.

2. Technical Compatibility

Forex traders require a device such as a smartphone, tablet, laptop, or desktop computer to access trading platforms. A crucial factor in selecting a platform is its compatibility with different devices. The best forex trading platforms ensure a simple and flexible configuration, enabling traders to execute trades seamlessly across multiple devices. Our selected platforms are optimized to work smoothly on any device, ensuring accessibility and ease of use.

Additionally, we examined whether platforms generate real-time technical reports for traders. Access to automated reports, market analysis, and trading signals allows traders to make data-driven trading decisions efficiently.

3. Software Type

Some traders prefer downloadable trading software, while others prefer web-based platforms that don’t require installation. Most top-tier platforms offer both options, ensuring flexibility for all types of traders. Although both versions provide similar functionalities, choosing between desktop-based or online forex trading platforms depends on personal preference. In our list of recommended platforms, we have included both downloadable and web-based options for you to select the one that best suits your needs.

4. Trading from Charts

Advanced forex trading platforms offer the ability to execute trades directly from charts, streamlining the trading process and improving efficiency. While not all trading platforms support this feature, the most advanced and modern forex platforms integrate chart-based trading, allowing traders to analyze trends and place trades without switching between multiple screens. Our review prioritizes platforms that offer seamless chart trading for better user experience.

5. Additional Features

While core functionalities are essential, some extra features can enhance the trading experience. The best forex platforms often include:

- Real-time forex news updates for informed decision-making.

- Automated trading (robotic trading) for hands-free strategy execution.

- Educational resources and tutorials to support traders at all levels.

Types of Forex Trading Platforms

Types of Forex Trading Platforms

Forex trading platforms can be categorized based on format, programming language, and trading models. Understanding these classifications helps traders choose the most suitable and efficient platform for their trading needs. Below is a brief overview of the different forex platform types.

1. Formats: Downloadable vs. Web-Based Platforms

Forex trading platforms primarily fall into two categories based on their format—downloadable software and web-based platforms.

- Downloadable Forex Trading Platforms: These platforms require users to download and install the software on their smartphone, tablet, or computer. Traders must log in using their credentials and maintain a stable internet connection for smooth trading. Examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Web-Based Platforms: Unlike downloadable platforms, web-based platforms run directly on a browser without installation. These platforms are typically built using Java or other programming languages, allowing traders to access their accounts from any device, anywhere. Due to their accessibility and convenience, web-based forex platforms are widely preferred in the industry.

2. Programming Language-Based Platforms

Some platforms are also categorized based on the programming language used in their development. However, most widely used forex platforms—such as MT4, MT5, and cTrader—fall under both downloadable and web-based classifications. These platforms are popular among forex traders due to their advanced charting tools, technical indicators, and automated trading capabilities.

3. Trading Model-Based Platforms

Forex platforms can also be classified based on the trading model they follow. The two primary types are:

- Dealing Desk Platforms: These platforms are primarily used by market makers. They act as an intermediary between traders and liquidity providers, where orders pass through the broker’s dealing desk. Examples of dealing desk platforms include MetaTrader and ActTrader.

- Non-Dealing Desk Platforms: These platforms provide direct access to liquidity providers, allowing traders to view real-time pricing quotes from multiple sources. Often referred to as Direct Access Trading (DAT) platforms, they eliminate broker intervention, offering a more transparent trading environment. Popular examples include Level II software and Currenex Viking.

Best Forex Trading Platform

Best Forex Trading Platform

As mentioned earlier, finding a single platform that perfectly meets all trading needs can be challenging. Each trading platform has its own strengths and limitations, catering to different trader preferences and strategies. However, after extensive research, testing, and analysis, we have identified the best forex trading platforms currently available in the market.

MetaTrader 4

MetaTrader 4 (MT4) is one of the most widely used and trusted forex trading platforms, originally introduced over a decade ago. Designed specifically for forex trading, MT4 has revolutionized the industry by providing a third-party trading platform that is more efficient, reliable, and feature-rich than the proprietary platforms offered by brokers at the time. Before the emergence of MetaTrader 4, brokers had their own trading software, many of which lacked accuracy and advanced functionalities.

Unlike a broker, MetaTrader 4 is solely a trading platform that brokers integrate into their services. Over the years, MT4 has gained significant credibility and trust, making it a must-have for many traders. Due to its popularity, brokers were compelled to offer MT4 alongside their proprietary platforms, allowing them to cater to a wider audience.

Key Features of MetaTrader 4

MetaTrader 4 is renowned for its robust functionality and user-friendly features, making it one of the best forex platforms. Some of its standout features include:

- One-Click Trading for fast trade execution.

- Over 50 Technical Indicators for in-depth market analysis.

- Expert Advisor (EA) Support, allowing automated trading.

- Multi-Charting Feature for better trend analysis.

- Customizable Limit Orders for trade automation.

- Nine Time Frames for precise market tracking.

- 23 Analytical Objects to enhance technical analysis.

- Copy-Trading Feature for mirroring successful traders.

- Built-in Market for Trading Tools and Custom Indicators.

- Algorithmic Trading Support for automated strategies.

- Mobile Trading Apps for iOS and Android, ensuring access on the go.

With these advanced features, MT4 remains one of the most preferred platforms for forex trading, providing traders with powerful tools for market analysis, trade execution, and automation.

Pros of MetaTrader 4

- Highly Stable and Reliable: MT4 is known for its stability, ensuring smooth trading with minimal disruptions.

- User-Friendly Interface: Its simple yet powerful design makes it ideal for both beginners and experienced traders.

- Mobile Compatibility: Offers highly functional mobile apps for iOS and Android, allowing traders to execute trades anytime, anywhere.

- Multiple Access Points: Available as downloadable software and a web-based trading platform, providing flexibility to users.

- Wide Broker Integration: Most top forex brokers offer MT4 due to its high demand and widespread adoption.

Cons of MetaTrader 4

While MT4 is one of the best forex trading platforms, it is not without its downsides:

- Broker-Specific Spreads: Some brokers manipulate spreads on MT4, offering wider spreads compared to their proprietary trading platforms.

- Performance Variations: Depending on the operating system and hardware, some users may experience slower performance.

- Limited Advanced Features: While MT4 is excellent for forex trading, it lacks some advanced functionalities found in its successor, MetaTrader 5 (MT5).

Meta Trader 5

Like MetaTrader 4 (MT4), MetaTrader 5 (MT5) is a widely used forex trading platform. However, unlike MT4, which is primarily designed for forex trading, MT5 is a multi-asset platform that includes support for stocks, commodities, futures, and CFDs. While MT5 offers additional features, its core functionality remains similar to MT4, and it does not introduce revolutionary improvements for forex traders.

Here are the key additional features of MetaTrader 5:

- Advanced Technical Analysis with more indicators and graphical tools.

- Fundamental Market Research for forex, exchange, and futures markets.

- C++-Based MQL5 Programming Language for creating sophisticated indicators and trading algorithms.

- Built-in Strategy Tester for testing automated trading strategies before live implementation.

- Multi-Asset Support, allowing trading across forex, stocks, commodities, and futures.

MetaTrader 5 Pros and Cons

MetaTrader 5 Pros and Cons

Pros of MetaTrader 5 (MT5)

While MT4 and MT5 are similar for forex traders, MT5 introduces several enhancements that provide additional flexibility and trading tools. Some key advantages include:

- 21 Timeframes: MT5 offers a broader range of timeframes, including minute, hourly, daily, weekly, and monthly charts, providing more granular market analysis.

- Six Types of Pending Orders: Traders have access to more advanced pending order options compared to MT4, allowing for greater control over trade execution.

- Netting & Hedging Modes: Unlike MT4, which supports only hedging, MT5 allows traders to switch between netting (for stock trading) and hedging (for forex trading).

- Depth of Market (DOM) Feature: Displays bid and ask prices at different levels, helping traders assess liquidity and order flow in real-time.

- Potential Bugs and Stability Issues: Since MT5 was coded from scratch, it initially experienced some bugs and performance issues, though continuous updates have improved its reliability.

- Not Backward Compatible with MT4: Traders cannot use MT4 indicators, scripts, or expert advisors (EAs) on MT5, making the transition difficult for those with existing MT4-based trading tools.

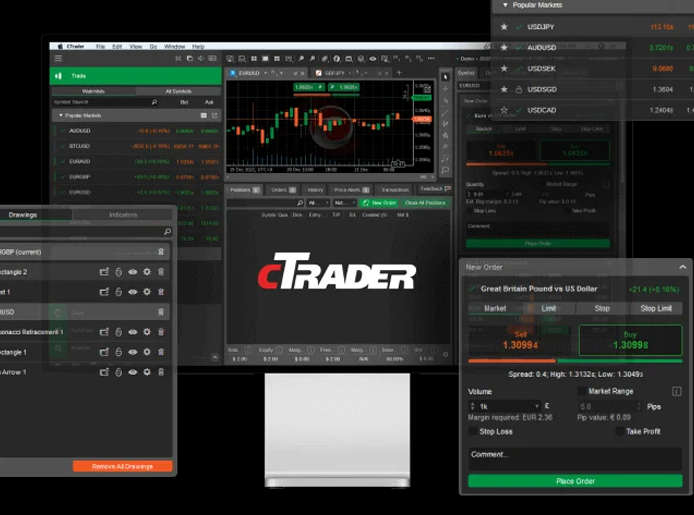

cTrader

cTrader is a London-based forex trading platform designed to compete with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Unlike MetaTrader, which is widely adopted by brokers, cTrader is specifically tailored for ECN (Electronic Communication Network) brokers, offering customized solutions for them. While it is not yet as widely available as MetaTrader, traders are gradually adapting to its unique features.

- Trading Sessions Display: Shows market hours and trading sessions based on real-time activity.

- Proxy Connection Settings: Provides secure and optimized connections for traders in restricted regions.

- Depth of Market (DOM) for ECN Brokers: Displays liquidity levels and bid/ask prices, helping traders make more informed decisions in the ECN trading environment.

Pros of cTrader

- User-Friendly Interface: cTrader is known for its clean and intuitive layout, making it an excellent choice for beginners.

- Advanced Charting Tools: After trade execution, traders can use comprehensive charting tools for market analysis.

- Pending Orders on Charts: Unlike some other platforms, pending orders are visible directly on the charts, improving trading transparency.

- Easy-to-Understand Charting Tools: The platform provides accessible and straightforward charting options, making technical analysis simpler for traders.

Cons of cTrader

Cons of cTrader

- Limited Auto-Trading Capabilities: Unlike MT4 and MT5, cTrader offers fewer automation tools, making it less suitable for traders relying on algorithmic trading or expert advisors (EAs).

- No Custom Indicator Support: Unlike MetaTrader, traders cannot create or modify custom indicators, which may limit advanced technical analysis.

- Primarily Web-Based: While cTrader is mostly a web-based forex trading platform, mobile applications are available only for Android and iOS users, restricting desktop traders from using a native application

ActTrader

ActTrader is a relatively new forex trading platform, yet it has already gained trust among traders due to its user-friendly charting tools and seamless navigation. One of its standout features is the ability to switch between multiple screens efficiently, helping traders optimize workspace usage.

- Easy-to-use interface with smooth navigation.

- Quick order execution with fast response time.

- Simple account tracking for traders.

- Multi-language support, making it accessible worldwide.

- Available on mobile devices, including phones and tablets.

Currenex

Currenex

Currenex is a third-party forex trading software that provides services to forex brokers. Unlike some platforms, Currenex does not have a direct relationship with any liquidity providers or brokers. This means that pricing varies significantly between brokers, as Currenex does not interact directly with banks.

- Advanced execution tools for institutional traders.

- Direct access to liquidity providers through participating brokers.

- Customizable trading interface for professional traders.

- Multiple order types to accommodate different trading strategies.

NinjaTrader

Founded in 2003 and operational since 2004, NinjaTrader is a forex trading platform that also supports stocks and futures trading. It is particularly popular among professional traders due to its automated trading capabilities, advanced charting tools, and trade simulation features.

- Automated trading strategies for algorithmic trading.

- Advanced charting capabilities with detailed analytics.

- Trade simulation tools for strategy testing.

- Multi-asset trading support, including forex, stocks, and futures.

eSignal

eSignal is a premium trading platform best suited for advanced traders who require a high level of customization. It allows users to create their own trading strategies, use advanced drawing tools, and track multiple symbols simultaneously.

- Fully customizable interface, making it ideal for professional traders.

- Advanced charting and drawing tools for in-depth technical analysis.

- Ability to view up to 500 symbols at once, offering a broad market view.

While MT4, MT5, and cTrader remain the most widely used forex trading platforms, traders looking for alternative solutions can explore ActTrader, Currenex, NinjaTrader, and eSignal based on their specific needs. ActTrader and Currenex cater more to institutional traders, while NinjaTrader and eSignal are ideal for advanced traders who require extensive customization and automated trading capabilities.