Plus500 Information

Plus500 is an online trading platform that offers 2,800 Contracts for Difference (CFDs) on cryptos, indices, forex, commodities, shares, and ETFs. It was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

Pros & Cons

Pros:

Simple and easy-to-use trading platform

Commission-free trading

Tight spreads

Negative balance protection

Regulated by reputable financial authorities

Free demo accounts

Cons:

No support for MetaTrader platform

Limited customer support options

Inactivity fee charged

Is Plus500 Legit?

Plus500 is considered legitimate as it is authorized and regulated by several top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

|

ASIC | Regulated | PLUS500AU PTY. LTD. | Market Making (MM) | 000417727 |

|

CySEC | Regulated | Plus500CY Ltd | Market Making (MM) | 250/14 |

|

FCA | Regulated | Plus500UK Ltd | Straight Through Processing (STP) | 509909 |

Market Instruments

Plus500 offers 2,800 CFDs, including:

Forex pairs major, minor, and exotic currency pairs

Stocks CFDs on stocks from various international markets

Indices CFDs on major stock indices like S&P 500, Nasdaq, FTSE 100, and more

Commodities CFDs on precious metals, energies, and agricultural products

Cryptocurrencies CFDs on popular digital currencies like Bitcoin, Ethereum, Litecoin, and more

| Asset Class | Supported |

| CFDs | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

Accounts

Plus500 offers two types of accounts: a live trading account and a demo account.

The live trading account requires a minimum deposit of $100 and provides access to real-time market prices and trading in over 2,800 instruments. Traders can use leverage of up to 1:30 for retail clients and up to 1:300 for professional clients. The live account offers various features such as stop loss, take profit, and guaranteed stop loss orders. There are no commissions charged on trades. Instead, the company earns money through the bid-ask spread.

The demo account is free and allows traders to practice trading using virtual funds with access to the same trading instruments as the live account. It is a great way for traders to learn how the platform works, practice trading strategies, and get familiar with trading instruments before investing real money. The demo account is available for unlimited time and can be used to test new trading strategies without the risk of losing real money.

Leverage

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It’s important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Spreads & Commissions

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads can start from as low as 0.5 pips for major currency pairs like EUR/USD. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

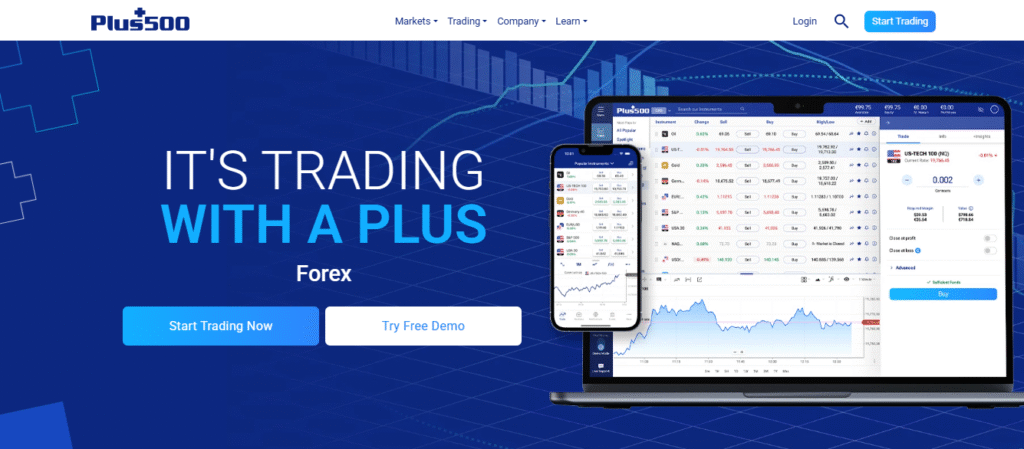

Trading Platforms

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Overall, the Plus500 trading platform is well-designed and functional, but it may lack some of the advanced features found in other trading platforms. See the trading platform comparison table below:

Deposits & Withdrawals

Plus500 accepts payments via Visa, MasterCard, PayPal, Skrill, Apple Pay, and Google Pay.

Plus500 does not charge deposit or withdrawal fees, but some payment providers may charge transaction fees, which should be checked with the provider directly. Plus500 also requires users to withdraw funds using the same payment method that was used for depositing funds, up to the deposited amount. Any excess profits can be withdrawn using any other payment method supported by Plus500.

Minimum Deposit Requirement

The minimum deposit requirement for Plus500 varies depending on the jurisdiction and the account type. In general, the minimum deposit ranges from $100 to $1,000. For example, in the UK, the minimum deposit is £100. In Australia, it is AUD 100, and in the EU, it is €100. It is recommended to check the specific minimum deposit requirement for your country and account type on the Plus500 website.

Education

Plus500 provides rich educational resources on their website, which includes trading academy, trader’s guide, beginner’s guide, webinars, ebook, FAQ, and news. The educational resources cover topics such as trading basics, technical analysis, and risk management.