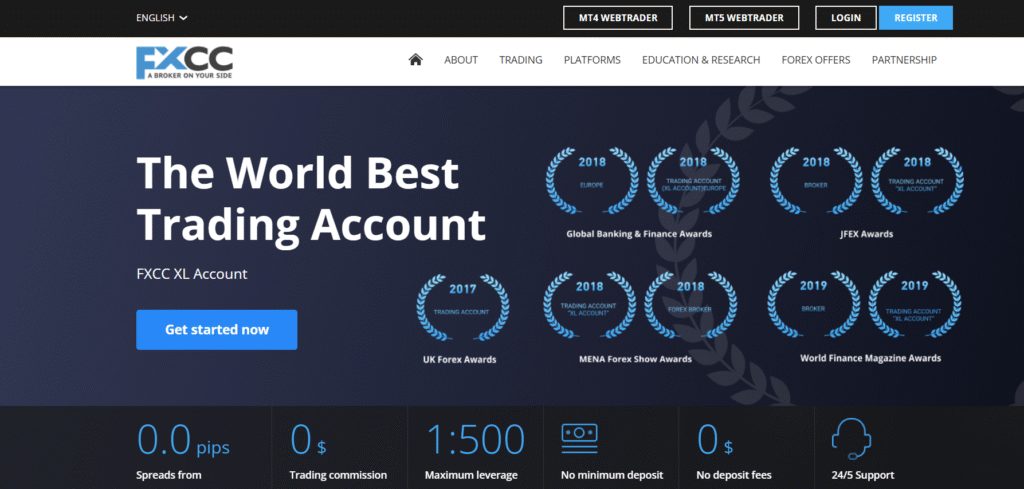

FXCC or FX Central Clearing is a Cyprus-established Forex broker founded in 2010 that provide forex exchange market professionals and retail traders access to trade currencies, cryptocurrencies, indices, energies, and metals through advanced technology. The company is known for its customer-centric approach by delivering competitive pricing with the most favorable trading conditions.

Being an NDD broker, FXCC provides quality execution and is a Trading provider that doesn’t take the other side of the trade meaning the broker is firmly on the traders’ side where all the orders, stops, limits, and trades are executed with counter-parties. What is also great, FXCC used technology to provide efficient and transparent pricing with the most possible low spreads. In addition, there is a range of ECN trading accounts that are designed to suit their own needs and requirements.

Regulation and Security Measures

FXCC Regulatory

FXCC is regulated by Cyprus Securities and Exchange Commission (CySEC) , a low risk trading broker. Due to the fact that the company is authorized by an EU Member State, the broker also automatically operates under EU Markets in Financial Instrument Directive (MiFID) along with cross-border registrations in its states, which allows the provision of services within the EEA.

Also, an additionalInternational entity FXCC serves is located in St. Vincent & the Grenadines and newly established Nevis and Mwali branch in Comoros. . Being an offshore zones, they do not define strict obligations to its financial registered firms, which may be a risky investment in case the firm is only based there. However, since FXCC is additionally authorized by the European regulator it is considered to be safe to trade with them.

How Safe is Trading with FXCC?

The protection of the client’s investments is provided in multiple ways according to the regulatory requirements and setter rules, yet always depends on the particular jurisdiction. Alike European regulation is way more strict and applies various rules, which apart from the segregation of the clients’ funds at all times, management and control of each type of risk complies to a number of rules.

Also, FXCC is a member of the Investor Compensation Fund, which secures the claims of covered clients against a company in case of its insolvency. Negative balance protection provided by FXCC guards traders from losing more than their account balance. Client money is also kept in separate accounts at Tier 1 banks, adding still another level of protection. For traders looking for a safe trading environment, FXCC is positioned as a consistent option by this mix of control, defensive actions, and financial transparency.

Consistency and Clarity

Established in 2010, FXCC has become known as a dependable broker in the forex trading space, regulated by the EU authority in Cyprus it provides reliable trading conditions overall. While International offering is provided by offshore zones it is still considered a reliable choice, but traders should be aware of various protective measures applied since they are strong at Cyprus entity not Internationally.

As for the consistency the Broker performs quite good operation along all the years and we didnt find serious breach of rules or fines imposed. In addition, real traders comments (which you may check underneath our review too) are mostly positive and there are many satisfied and happy traders at FXCC which is another plus to its clarity.

Account Types and Benefits

As we find at FXCC Account offerings there are two ECN accounts offered which differ by the level of trading size, experience, and particular demands. The most popular and widely used FXCC ECN XL Account features extra benefits of zero swaps, commissions, or mark-ups, or might be fully tailored solution for active traders or those who operate bigger sizes. Yet, as we notice ECN Promo account is currently unavailable for signing so mainly FXCC Login to ECN XL is available.

So trading with FXCC ECN account you will automatically access multiple currencies EUR, USD, GBP featured with tight spreads from 0.01 pips and availability to trade 30 currencies with a range of free tools alike VPS, SMS Notifications, EAs, Technical Analysis and Trading Tools.

Cost Structure and Fees

FXCC Brokerage Fees

Trading with FXCC ECN account you will access multiple currencies EUR, USD, GBP featured with tight spreads from 0.01 pips as mentioned on Broker site, yet to see the full fee structure be sure to check all the conditions including applicable commissions, funding fees and inactivity fees apart from the direct trading fees mainly built into Spreads. Here’s a detailed overview of the various fees associated with trading on the platform:

- FXCC Spreads

FXCC uses a spread-only methodology; hence, its ECN XL account shows no extra trading commissions. Spreads on important currency pairings start as low as 0.1 pips, which appeals to budget-conscious traders. For EUR/USD the average spread is about 0.8 pips, which is reasonable given many other brokers. Still, spreads depend on liquidity and market conditions.

- FXCC Commissions

Under its ECN XL account, FXCC charges no trading commissions; it depends on competitive spreads to make money. For high-frequency traders trying to cut expenses, this structure appeals especially. Further improving the broker’s cost-effectiveness without deposit or account maintenance fees.

- FXCC Rollover (Swap Fees)

Also, always consider FXCC rollover or overnight fee as a cost, which is charged on the positions held longer than a day defined by each instrument separately. However, trading with ECN XL Account broker promises no swap charges, which is very attractive since not so many Brokers as per our experience provide this kind of offering, so making you an easy calculation of trading position and great benefit too.

FXCC charges swap fees for overnight held positions. The asset being traded will affect these fees, which apply to both long and short positions. Swaps can be either positive or negative based on the interest rate differential between the two currencies in a currency pair. FXCC does not charge particular fees for overnight holding of positions outside the average swap rates.

Trading Platforms and Tools

FXCC Forex trading platforms, are based on highly regarded MetaTrader4 and MetaTrader5 in fact like many ECN brokers. FXCC platform software was developed to suit a downloadable version to be installed on a PC, a mobile application to follow trades on the go, a Multi-Terminal for simultaneous management of multiple accounts and is a MAM Broker.

The platform is available for all operating systems and fully compatible with EAs, hedging and equipped with advanced technical indicators, analytical objects, and charting tools.

However, the lack of alternative platforms is a major drawback, also some traders find MT4 slightly outdated.

Web Platform

FXCC runs on the most commonly used MetaTrader 4 (MT4) platform, which is well-known for dependability and sophisticated trading tools.

However, FXCC does not have a specific web-based trading platform; all trading is done using desktop or mobile applications based on MT4 software. This restriction could be a disadvantage for traders who want web access for convenience.

Desktop MetaTrader 4 Platform

The FXCC MetaTrader 4 (MT4) desktop platform offers quality trading experience characterized by its reliability and advanced features. The platform showed seamless trade execution across several asset classes, including FX, CFDs, and cryptocurrencies, during testing. The user-friendly interface let for speedy trade placements and effective market data navigation.

Technical indicators and broad charting tools of MT4 give traders complete analytical capacity. By means of Expert Advisors (EAs), the platform offers automated trading, empowering algorithmic traders to apply their ideas efficiently. For both new and seasoned traders looking for a strong but straightforward trading environment, FXCC’s MT4 platform is an overall fit.

Main Insights from Testing

Key results from testing the FXCC PC platform expose flawless execution of transactions, real-time market data, and many analytical tools necessary for efficient trading methods. Widely known for its simple interface and strong trading capabilities, the MetaTrader 4 (MT4) platform is the only supported choice by FXCC. Even though design of MT4 might be slightly outdated, also some capabilities should be added on as extra, like VPS, overall platform showed good performance, also execution based on ECN connectivity is very good.

Desktop MetaTrader 5 Platform

FXCC has recently introduced the newer version of the MT4 platform, MetaTrader 5, with more advanced conditions and opportunities. The platform is available through the broker’s ECN XL account, with no commissions and spreads starting from 0 pips. MT5 includes excellent analytical tools, deep insights into each instrument through 21 available timeframes, and access to a wide range of technical indicators, charts, and graphs. In addition, the FXCC’s MT5 platform includes trading alerts, an in-built economic calendar, and the MQL5 programming language to build custom tools and trading robots. The platform is available for PC, macOS, Android, and iOS, enabling better accessibility for traders.

MobileTrader App

Based on the MetaTrader 4 and 5 platforms, the FXCC MobileTrader app offers customers a strong trading experience on demand. After testing the app, it turned out that it provides real-time market access, sophisticated charting tools, and a range of technical indicators, among other basic capabilities. Benefiting from the same competitive spreads and execution speeds on the desktop platform, users may efficiently execute trades with only a few taps. Especially the MT5 mobile app stands out for its sophisticated tools and efficient solutions.

Trading Instruments

What Can You Trade on FXCC’s Platform?

Based on our findings, the broker offers a good range of trading instruments with over 200 Trading products all based on FX and CFDs trading. It allows trading major, minor, and exotic currency pairs, and cryptocurrencies with access to Bitcoin, Litecoin, and Ethereum, major indices from the EU, US, UK, and Asia. It also allows the trading of precious metals and energies.

Leverage Options

As the majority of Forex brokers, FXCC also offers to use leverage, a powerful tool to increase the potential of gains through its possibility to multiple initial accounts balance. However, leverage should be used smartly as it increases the power of losses as well.

- European retail clients and those who trade with the Cyprus FXCC entity are eligible to use the leverage of 1:30 for major currencies, 1:20 for minor ones, and 1:10 for commodities due to ESMA restrictions.

- Yet, trading with the global FXCC branch you may access higher leverage ratios that go to a maximum of 1:500.

Leverage levels depend on the instrument you trade and are defined by the regulatory restrictions together with your personal level of proficiency.

Deposit and Withdrawal Options

Deposit Options

FXCC offers a range of handy deposit options to suit traders’ requirements. Instant funding for users’ accounts comes from bank wire transfers, Visa, Mastercard, Skrill, Neteller, and cryptocurrencies, also Neosurf, SOfort, Rapid, paysafecard, Neosurf, Yandex, Boleta, UnionPay and much more. FXCC notably charges no deposit fees, thereby enabling traders to begin free from further expenses.

While bank transfers could take longer, e-wallet transactions usually take one hour, and deposits are handled rapidly. FXCC enables accounts to use USD, EUR, and GBP, among several currencies. This adaptability serves a wide range of traders, improving the user interface. All things considered, FXCC’s deposit options enable effective fund management, making it available to new and seasoned traders.

Minimum Deposit

FXCC does not impose any minimum deposit requirement for opening a live trading account, making it accessible for traders to start with any amount they are comfortable with. However, according to the payment method the minimum amount ma vary from 50 to 100$ per transaction so be sure to check those conditions, which we find slightly different in each FXCC entity too.

Also, a recommended minimum deposit of $500 is suggested for those looking to maximize their trading experience and access additional features.

Withdrawal Options

In addition to the selection of major withdrawal options making payment quite well-orhanized, we also notice the broker covers processing fees for both deposits or withdrawals. Yet, we advise always check with a particular payment provider in case of any other additional fees relevance or its possibility.

Customer Support and Responsiveness

Testing FXCC’s Customer Support

Based on our findings, the broker provides excellent customer support available 24/5 through email, Live Chat, and international phone calls available in multiple languages allowing clients from across the globe receive quality customer support

- Customer Support in FXCC is ranked Excellent based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, the main point is the lack of 24/7 availability

Research and education

FXCC provides quality research tools meant to improve traders’ market analysis and decision-making capacity. Although FXCC’s research products are helpful for traders, they might not be as thorough as those of other top brokers; hence, users should always augment their research with other sources as needed.

Some of Research tools included into the proposal that can be find either directly on the provided MT4 platform or on Broker Official Website include:

- Forex calculators among these instruments let traders compute margins, pips, and risk levels, thereby enabling improved trade management. Traders wishing to maximize their holdings and properly control their exposure depend on these calculators.

- FXCC live quotations, which provide real-time market data, enabling traders to be current on price changes on several instruments. Making wise trading decisions in a market driven by fast changes depends on this ability.

- Additionally, the broker provides an economic calendar that lists forthcoming releases and events. This instrument enables traders to prepare their strategy in line with possible market volatility.

- FXCC market analysis focused on key currency pairs, thereby revealing possible trading prospects depending on present market conditions. New traders could spend more analyzing the market and get experience for your self. Regular updates reflecting the most recent market trends allow the broker to offer trading signals for particular pairs of currencies and metals.

Education

Serving both beginner and experienced traders, FXCC has a variety of instructional materials meant to improve traders’ knowledge and skills. Basic e-books, educational articles, and a dictionary of key trading terms—which act as fundamental tools for understanding market dynamics—are available through the broker. Although the training materials are valuable, they are minimal compared to more all-encompassing offers from top brokers.

FXCC also includes demo accounts so users may hone their trading techniques free from financial risk. This helpful method enables traders to put their expertise into use in actual market environments. Nevertheless, the instructional resources’ absence of interesting components like interactive quizzes or films could compromise the learning process. Although FXCC offers necessary teaching tools, traders looking for comprehensive training materials could find the offerings inadequate to acquire advanced trading skills.